Investment Banking – Qualitative best practices (Basic)

What an analyst or a summer intern placed in an investment banking firm can expect the first tasks in the qualitative area?

Company Profiles

As a summer intern or an investment banking analyst, creating company profiles is one of the first tasks assigned in an investment banking firm. These profiles are typically created for internal purposes, client requirements, or when a deal becomes active.

Types of Company Profiles:

Basic: A single slide per company or "strip profiles" (multiple companies, e.g., 4-5, on one slide), provides a brief description of the company’s business, products, key financial metrics, and other relevant details.

Detailed Profile: Multiple slides on a company, including historical financials, projected financials, product overviews, geographical breakdowns, annotated stock charts, and other comprehensive details.

Preparing a Company Profile:

An analyst must refer to past examples of company profiles and follow the same template and format, including content, font, and writing styles. Research should focus on key metrics, ensuring a thorough understanding of the sources used in the sample and replicating the research process.

The best practice for conducting secondary research begins with the company website and press releases. Analysts should turn to credible third-party sources such as PitchBook, S&P, Bloomberg, and others if the necessary information is unavailable there. One should avoid using third parties that rely on arbitrary databases, such as Tracxn, Crunchbase, and similar platforms.

Newsletters

In investment banking, newsletters are important in keeping internal team members and clients updated on the latest developments, such as mergers and acquisitions, market trends, industry news, financial insights, and more.

These newsletters provide valuable perspectives on market trends and financial insights, helping bankers offer high-quality services to their clients.

Most commonly, newsletters are industry- or sector-specific and highlight key developments relevant to the industry.A basic format would include:

Date (MM/DD/YYYY): A brief description of the news, emphasizing company names. The language should be in the past tense, avoiding marketing or promotional phrases like “best food company” or “unbeatable performance,” etc.

Example:

12/09/2024: KPI Green secures CEIG approval for 16MW solar projects under the CPP segment – the project was executed for KPI’s clients and developed through its wholly owned subsidiaries: KPIG Energia and Sun Drops.

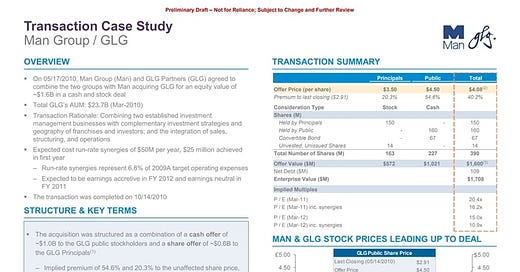

Case Study

Analysts are expected to work on case study transactions, which were done in the past. There could be various purposes but the prominent one is for M&A transactions, investment banks explain the clients how a similar transaction was done in the past.

It involves pulling the data from the deal memo if it was done by your firm, or searching through the company websites and press releases of the relevant parties involved in the M&A transaction

One case study usually involves a single slide and it captures a brief description of the company’s operation (both buyer and seller) and an overview of the transaction, answering the following key questions:

Q1 What were the terms of the deal?

Q2 Whether there was some synergies from the transaction?

Q3 If public company, then what were the share price reactions towards this deal?

Q4 How was the structure of the transaction? (for example, simple one acquirer and one target or complex one where various subsidiaries or investors/banks/other parties involved

Example of a case study:

Though the above mentioned are not an exhaustive list of the initial tasks, they are standard practice in almost any investment banks or boutique for new joiners to work on the qualitative side.

Other tasks may also involve making changes to the specific slides of the current deal, share price reaction charts, creating the management and board slides, preparing the guestlists, investor research, and others. However, the basics of investment banking in the quantitative area are not covered yet, there is another upcoming post on the same. Stay tuned.